Property taxes in France and what’s new in 2023:

* abolition of housing tax(taxe d’habitation) for main residences, but still applicable for secondary residences (not rented as a main residence)

* obligation to declare occupancy of the property before 30 June 2023, the deadline has now been extended to the 31st of July

WHO PAYS TAXE FONCIERE and TAXE HABITATION

the taxe foncière(property tax) : is due each year by the “owner” of real estate (house, land, garage, etc.) on 1st of January of the year.La taxe d’habitation(residence tax) is due each year by the “occupant of the accommodation” on January 1 of the year, whether it is a main or secondary residence, rented empty or furnished. The person liable for the housing tax changes according to different criteria.

NEW in 2023: The taxe d’habitation is abolished if the property is used as a main residence (occupied by the owner or his tenant), it remains due for use as a secondary residence (personal use and/or seasonal rental) or if vacant.

Exemptions and reductions exist for these taxes, but depend on your personal situation and will not be discussed here.

WHEN TO PAY :

Both tax bills only arrive in the last quarter of the current/running year and are due by the owner on January 1 of the same year.

All owners should receive these notices by post at their home address

HOW TO PAY :

Online, through the Government website or by bank wire transfer.

It only works with electronic payment on line (type of single direct debit) and is possible with an IBAN account (so also valid for IBAN accounts outside France). Not possible to pay by credit card on line, so how to do so: you’ll need your numéro fiscal and numéro de référence d’avis which are mentioned on your taxe notice

To create your account, log in to https://www.impots.gouv.fr/accueil , espace « particulier »

You can create your account with your numéro fiscal which is made up of 13 digits and is a unique number.

You can also pay online “without creating an account”, with the « référence d’avis » which is a different number for each notice.

If you are used to paying by bank transfer, this is still possible but don’t wait till the last due date: many of our “non-resident” clients have received a reminder with a fine of 10% since their payment had not been registered yet the day of the reminder.

ADVICE FOR SELLERS/BUYERS : How does it work in case of a sale ?

In the case of a real estate sale in the current year: a pro rata is provided on the day of the signing of the deed at the notary, the owner on January 1 of the year (seller) receives and pays the entire invoice, the new owner (buyer) advances or reimburses his pro rata share on the day of the completion of the final deed. ATTENTION this counts only for the taxe foncière, the tax d ’habitation remains entirely due by the seller.

In the case of a real estate sale the following year:The purchaser receives his first tax notice by post at his home address the year following the year of his acquisition. CAUTION if you change your address, remember to inform the tax department. Property registration services have delays, so it is possible that the seller still receives this notice, if this would be the case, you just have to inform the taxe service of the sale by attaching a copy of the certificate that you would have received from the notary.

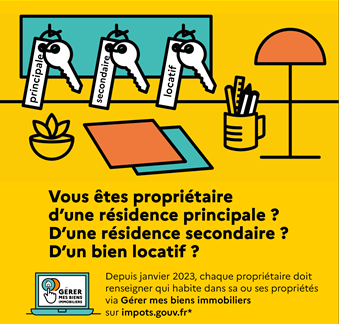

LA DECLARATION D’OCCUPATION : NEW in 2023 !

ALL owners (individual and company owners, family SCI, etc.) of a main or secondary residence or rental property must, for each of their properties, indicate in what capacity they occupy them and, when they do not occupy them themselves, provide the identity of the occupants and the period of occupation (situation as of January 1, 2023). This declaration must be made online, via the online service “Mon bien immobilier” on impots.gouv.fr, before 31st of July 2023. This only concerns buildings, un-build land is not concerned.

This Declaration of occupation is necessary for updating the tax service files:

*files of secondary residences, still liable for the tax d’habitation

*files of unoccupied and vacant housing (unfurnished): tax on vacant housing (applied in certain regions in France).

So in order to be able to declare (this is only possible by internet) you will have to create your account on the government site.

https://www.impots.gouv.fr/accueil , espace « particulier »

A PDF usersguide and a VIDEO tutorial is at your disposal, in english (both explain how to create an account and consult the details of all your real estate premises, it does not indicate yet how to declare, …)

usersguide PDF : mesbiensimmobilier-usersguide

video tutorial https://www.youtube.com/watch?v=byFTpJVJtIc

The different types of occupation:

*Principal residence, occupied by the owner or a tenant

*Secondary residence, owner-occupied or short-term rentals (seasonal)

*Not occupied: vacant accommodation (unfurnished)

DECLARE OCCUPANCY:

Go to the “mesbiensimmobiliers” tab “declaration occupation”, for each property you must provide the names, first names and dates of birth of the occupants (except children), and the date of occupation (in the majority of cases it will be 01/ 01/2023 if not prefilled yet), if your property is rented, you can mention the amount of the monthly rent but it’s not obliged.

This information probably is already prefilled for primary residences (known by taxservice):

*if complete and correct: click on “aucun changement” to finalize your declaration

*if incomplete: click on “nouvelle situation” and declare accordingly.

You can add or delete occupants.

You have to do this for each premise mentioned(so also for garage, pool etc if they are mentioned separately).

If you own trough a company (non-individual or SCI) you need to create an account under “espace professionel”. In this case and/or if you rent out your property as seasonal letting through a professional intermediary, we advise you to contact this intermediary and/or your accountant to help you and avoid reporting errors and/or double taxation.

The “non-declaration” or the “mis-declaration” before June 30, 2023, is subject to a fine of 150 € per premises, …

ADVICE BUYER/SELLER:

If you were buyer in 2022, this does not concern you “not yet”, if you don’t have a fiscal number in France,you just have to wait for your first notice, which you should receive in September 2023, if you would have changed your address since your purchase, you should report it to the tax office of your area.

If you were a seller in 2022, it’s possible the property still appears on the list, in this case you should report this to the relevant taxe service, possible on line under “contact et RV”.

HELP/IT DOESN’T WORK?

It’s new, so there may be “bugs”, … impossible to finalize/validate your declaration?

You can also call the local tax department to assist you or solve the problem:

from abroad : tax service Carcassonne: +33 468774444, Narbonne: +33 468321193

from France : 0809 401 401

As you go through these procedures, you can check the “composition of your property” how it is declared and known at the tax services: Under the “bien immobilier” tab you will find all your properties with a printable “detail” file, this file mentions, ao, the habitable surface, the number of rooms, outbuildings (garage, swimming pool, …), …

SELLER/PURCHASER notice: this tool allows you to check if the property tax of the property is up to date 😊, and avoid unpleasant surprises later.

Through your account, you can also download and pay your future tax bills, in case you did not receive them on-time by post.

“Buying or selling a property in the Aude between Narbonne and Perpignan with Audevie. As a Real Estate license holder and member of the French real estate federation (FNAIM) since 2006, we guide our national and international clients from presale contract till signature final deed.”

AFTERSALE service: if you have questions or need assistance don’t hesitate to contact us!